The 9-Minute Rule for Boomerbenefits.com Reviews

Wiki Article

How Plan G Medicare can Save You Time, Stress, and Money.

Table of ContentsThe Facts About Attained Age Vs Issue Age RevealedAarp Medicare Supplement Plan F for Beginners3 Simple Techniques For Medigap Plan GOur Largest Retirement Community In Florida PDFsThe Buzz on Aarp Medicare Supplement Plan F

(by mail), even if they do not likewise obtain Medicaid. The card is the mechanism for health and wellness care companies to bill the QMB program for the Medicare deductibles and also co-pays.

Links to their webinars and also other resources goes to this link. Their information consists of: September 4, 2009, updated 6/20/20 by Valerie Bogart, NYLAG This short article was authored by the Empire Justice Facility.

How Medigap Plan G can Save You Time, Stress, and Money.

Each state's Medicaid program pays the Medicare cost-sharing for QMB program participants. Anyone that gets approved for the QMB program doesn't need to pay for Medicare cost-sharing and also can't be billed by their healthcare companies. If an individual is considered a QMB And also, they meet all criteria for the QMB program yet likewise fulfill all economic demands to obtain complete Medicaid solutions.

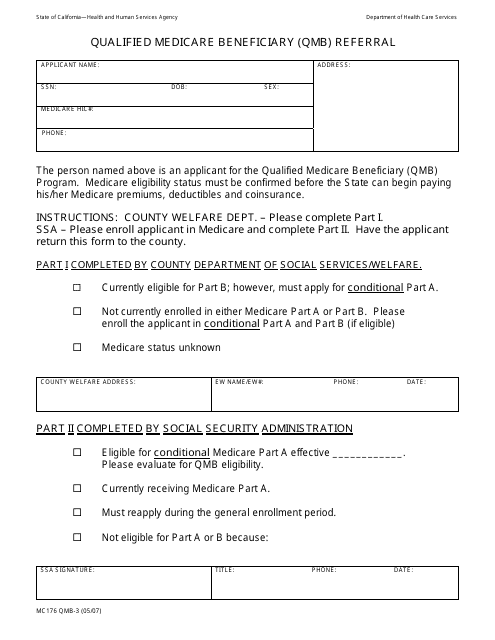

The very first step in enrollment for the QMB program is to figure out if you're eligible. A fast as well as simple way to do this is to call your local Medicaid office. The next action is to finish an application. You can request Medicaid to offer you with an application type or find a QMB program application from your state online.

There are instances in which states might restrict the amount they pay health treatment carriers for Medicare cost-sharing. Also if a state limits the amount they'll pay a company, QMB members still do not have to pay Medicare carriers for their healthcare prices as well as it's versus the regulation for a supplier to ask to pay - medicare supplement chart.

Normally, there is a premium for the plan, however the Medicaid program will pay that premium. Numerous people pick this additional protection since it gives regular oral and also vision care, as well as some come with a gym subscription.

The smart Trick of Medigap Plan G That Nobody is Talking About

Select which Medicare plans you would certainly like to compare in your area. Compare prices side by side with strategies & carriers offered in your area.He my site is featured in numerous publications as well as writes on a regular basis for other skilled columns pertaining to Medicare.

Several states allow this throughout the year, yet others limit when you can enroll partially A. Remember, states use different rules to count your revenue as well as properties to determine if you are qualified for an MSP. Instances of income consist of wages and Social Safety and security advantages you get. Instances of properties include checking accounts as well as supplies.

* Certified Disabled Functioning Individual (QDWI) is the fourth MSP and pays for the Medicare Part A costs. To be qualified for QDWI, you should: Be under age 65 Be working however proceed to have a disabling problems Have limited income as well as possessions As well as, not already be qualified for Medicaid.

The Buzz on Attained Age Vs Issue Age

20 for each brand-name medication that is covered. Additional Assist only applies to Medicare Part D.

Different states might have various methods to compute your income as well as sources. Let's check out each of the QMB program eligibility criteria in more detail below.

The monthly earnings restriction for the QMB program increases annually. That suggests you ought to still look for the program, also if your income increases slightly. Resource limitations, In addition to a monthly earnings limit, there is additionally a source limit for the QMB program. Items that are counted toward this limitation consist of: cash you have in monitoring and financial savings accountsstocksbonds, Some sources do not count toward the source limitation.

Examine This Report on Plan G Medicare

, the resource limits for the QMB program are: $7,970 $11,960 Resource limits additionally increase every year. As with revenue restrictions, you should still apply for the QMB program if your sources have actually slightly increased.Report this wiki page